Invoice Management

Turn Invoices Into Insights. Automate, Approve, Achieve.

Automate Invoice Workflows

Our invoice management tool eliminates delays and mistakes that come with manual invoice processing. Instead of uploading PDFs and sorting through spreadsheets, let the software review, validate, and route invoices for approval.

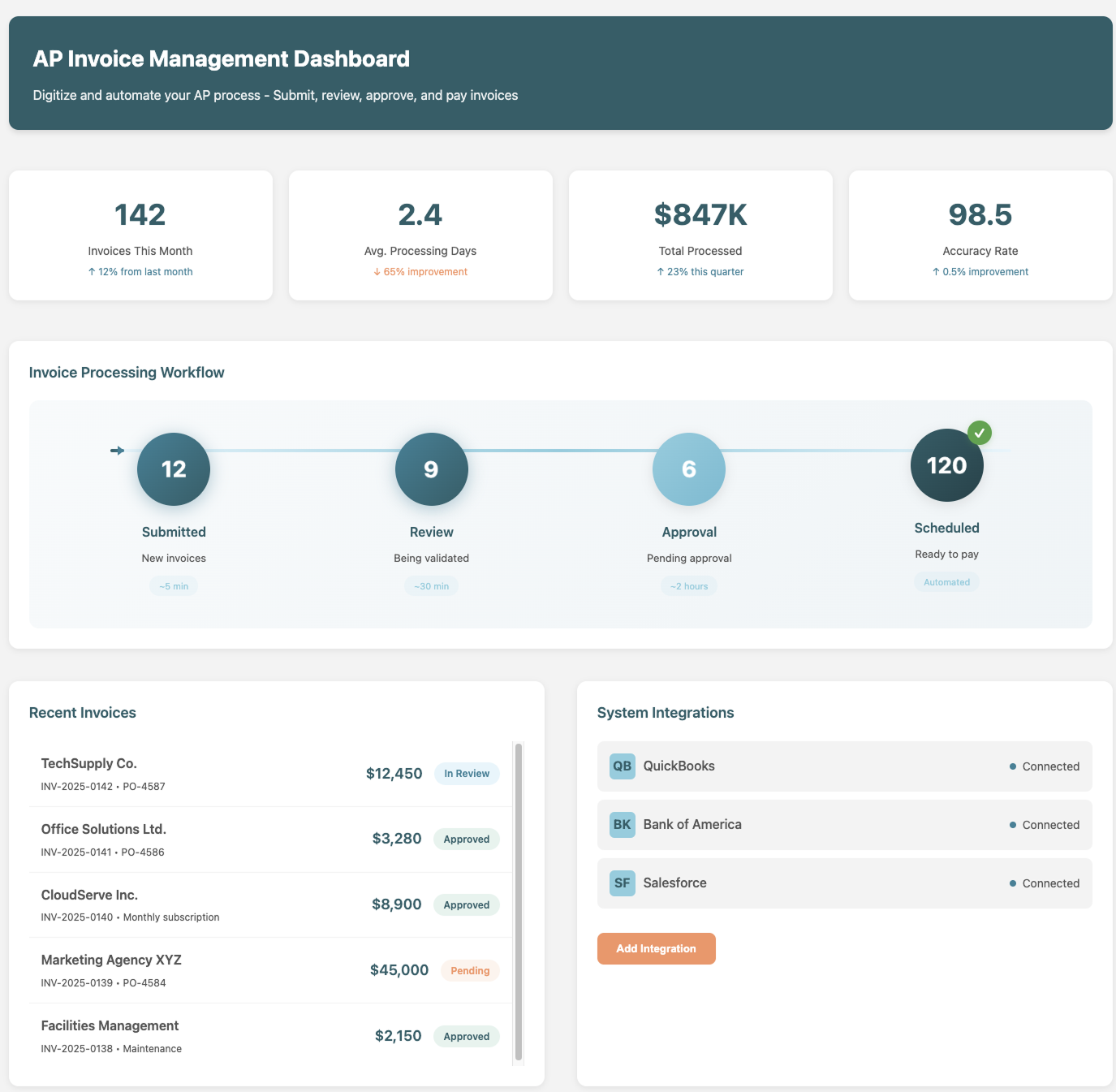

Match, Approve, Track

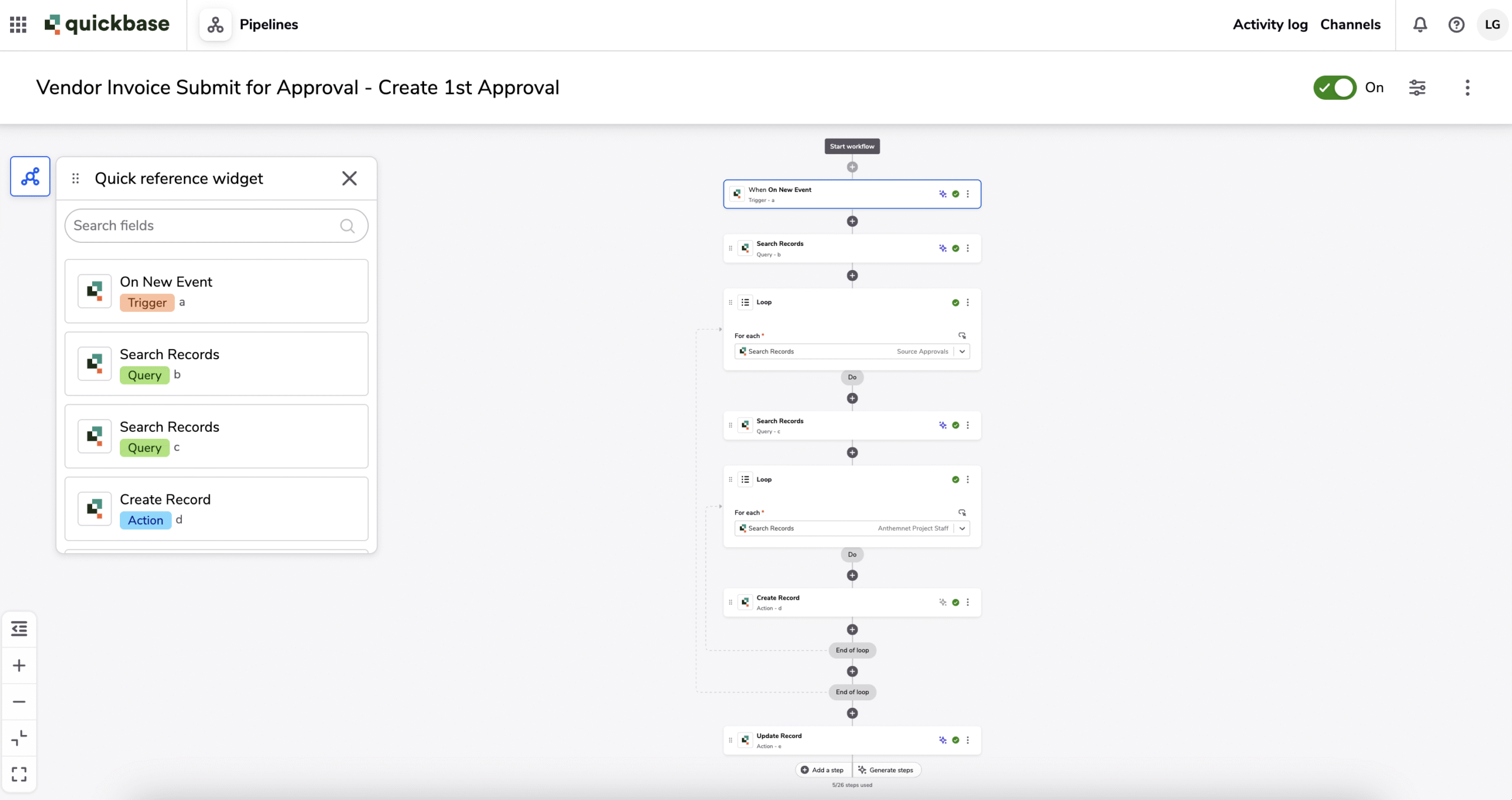

Invoices are matched against vendors, purchase orders, and pricing policies. Once approved, payments are scheduled automatically, and all records are kept in one place for easy audit tracking.

Integrate And Elevate: Smarter Spend Management

ntegrated with your accounting system, bank, or payment processor, the tool saves time and money across the entire procure-to-pay process. Your team can focus on strategic finance rather than chasing signatures or fixing entry errors.

FAQ

Automated invoice management software reads, validates, and routes invoices for approval—no manual data entry or spreadsheet sorting. By eliminating keystroke errors and bottlenecks, teams process payables faster, avoid late-payment fees, and gain real-time visibility into cash flow.

Each invoice is automatically matched against approved vendors, purchase orders, and pricing policies. When all criteria align, the system records the match, triggers a one-click approval, and queues the invoice for payment scheduling—keeping every decision in a single audit trail.

Yes. The platform connects directly to popular accounting suites, banking portals, and payment processors, so data flows from invoice capture through payment without duplicate entry. Integration shortens the procure-to-pay cycle and keeps ledger balances current.

Because every invoice, approval step, and payment confirmation is logged in one place, finance teams can export a clean, time-stamped history for auditors in minutes—reducing compliance risk and speeding year-end close.

Customers typically see faster approvals, lower processing costs, and fewer payment errors. By saving staff from “chasing signatures” and fixing data issues, finance can shift focus to strategic spend analysis and cash-management decisions that drive growth.